Why Does Any

Business Need PaaS?

Businesses should consider adopting Payment-as-a-Service (PaaS) platforms for several important reasons:

Save Money & Earn Cashback

PaaS can help businesses avoid late payments and penalties, saving them money. Additionally, PaaS platforms often offer cashback rewards for international payments, allowing businesses to earn money while spending.

Instant Payments

Traditional B2B payments can take a long time to reach suppliers, which can harm a business's reputation and prevent them from accessing discounts. PaaS solutions process payments quickly, ensuring payments are never missed.

Expense Tracking

Unlike manual methods such as spreadsheets, PaaS systems provide clear visibility and transparency for all payments. Every payment is recorded within the system, making it easier to create effective budget plans and monitor.

Data Management

PaaS platforms securely store accounting data, enabling businesses to analyze their financial history. This data is valuable for making accurate predictions and informed decisions about the future.

Empower Your

Business with PaaS

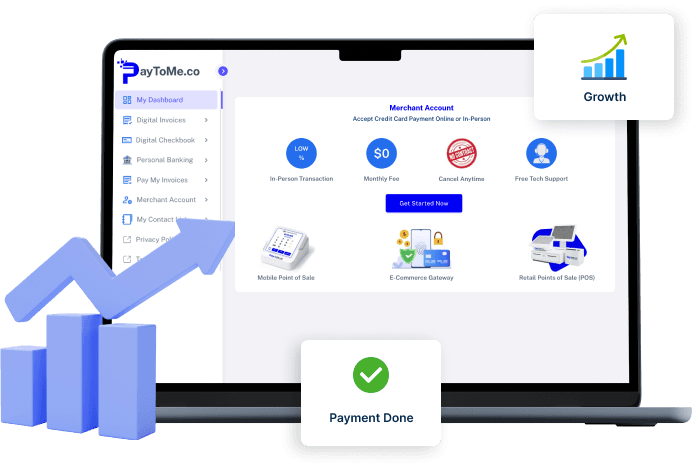

We have the perfect payment solution—it's fast, secure, and endlessly customizable.

Make international payment with PaaS

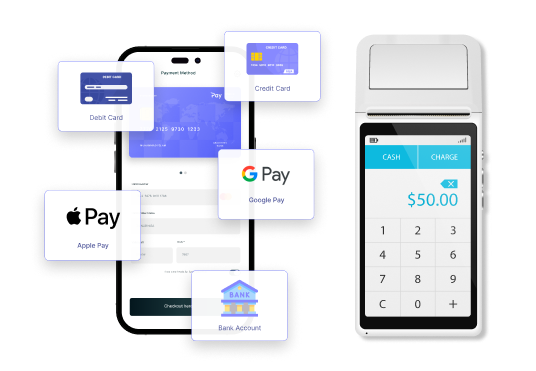

The platform provides a range of features including secure payment processing, fraud prevention, recurring billing options, and customizable payment forms. Additionally, PayToMe offers support for international payments, enabling businesses to accept transactions from customers around the world.

Simplify Payment Operations

Focus on what matters most - your business. With PayToMe's PaaS, we take care of the complexities in payment processing, allowing you to effortlessly accept payments from various channels, including online, in-store, and mobile.

Easy to Use, Get Paid Faster

As your business expands, our PaaS platform scales with you. Enjoy the flexibility to handle growing transaction volumes, accommodate new payment methods, and seamlessly integrate with your existing systems, all while ensuring a smooth customer journey.

Clear Reporting with Effortless Payment

PayToMe's PaaS solution also includes reporting and analytics tools, allowing businesses to gain insights into their payment processing activities and customer behavior. The platform is designed to be developer-friendly, with easy-to-use APIs and SDKs that streamline the integration process.

Reliable & Secure Payment Platform

Our comprehensive fraud prevention measures to safeguard international transactions, giving businesses and customers peace of mind when conducting cross-border payments.

Key Benefits of

PayToMe's PaaS

Enhanced Security

Comprehensive Analytics

Customer-Centric Experience

Payment Notifications

Account Management

PayToMe's SaaS-based

Payment solutions

In addition to PaaS, PayToMe provides a comprehensive suite of payment solutions to cater to various business needs. These solutions include:

Digital Checkbook

Text to Pay

Merchant Services

Online Checkout Options

Account Payables

Account Receivables

Expense Management